Message from the President

Thank you for visiting the of IPS Holdings.

Since our founding over 25 years ago, we have focused exclusively on implementing and maintaining SAP ERP systems. We have provided SAP ERP solutions to more than 180 companies and have established one of Japan’s leading global support frameworks through collaboration with SAP partners in approximately 70 countries. We are honored to be recognized by many of our clients and SAP itself as a top-tier SAP partner, holding the prestigious status of a Platinum Partner—an accolade granted to only about 10 companies in Japan.

We are not in pursuit of trendy IT businesses or superficial SAP implementation work. Our business does not revolve around repackaged technologies or second-rate solutions. We aim to deliver truly value-added services that are unique and unmatched.

Even in our core SAP business, we continue to transform in response to evolving customer needs and the latest SAP technologies and products. We challenge ourselves to remain at the forefront of the market, advancing technology while avoiding fleeting trends and focusing on authentic, foundational business practices.

To ensure stakeholder confidence, we are committed to stable corporate management and transparent, accurate disclosure of information. Especially for our shareholders, we pledge to engage sincerely and work toward creating and returning greater profits.

We greatly appreciate your continued support and trust.

IPS Holdings Co., Ltd.

Hiroshi Watanabe

President and Chief Executive Officer

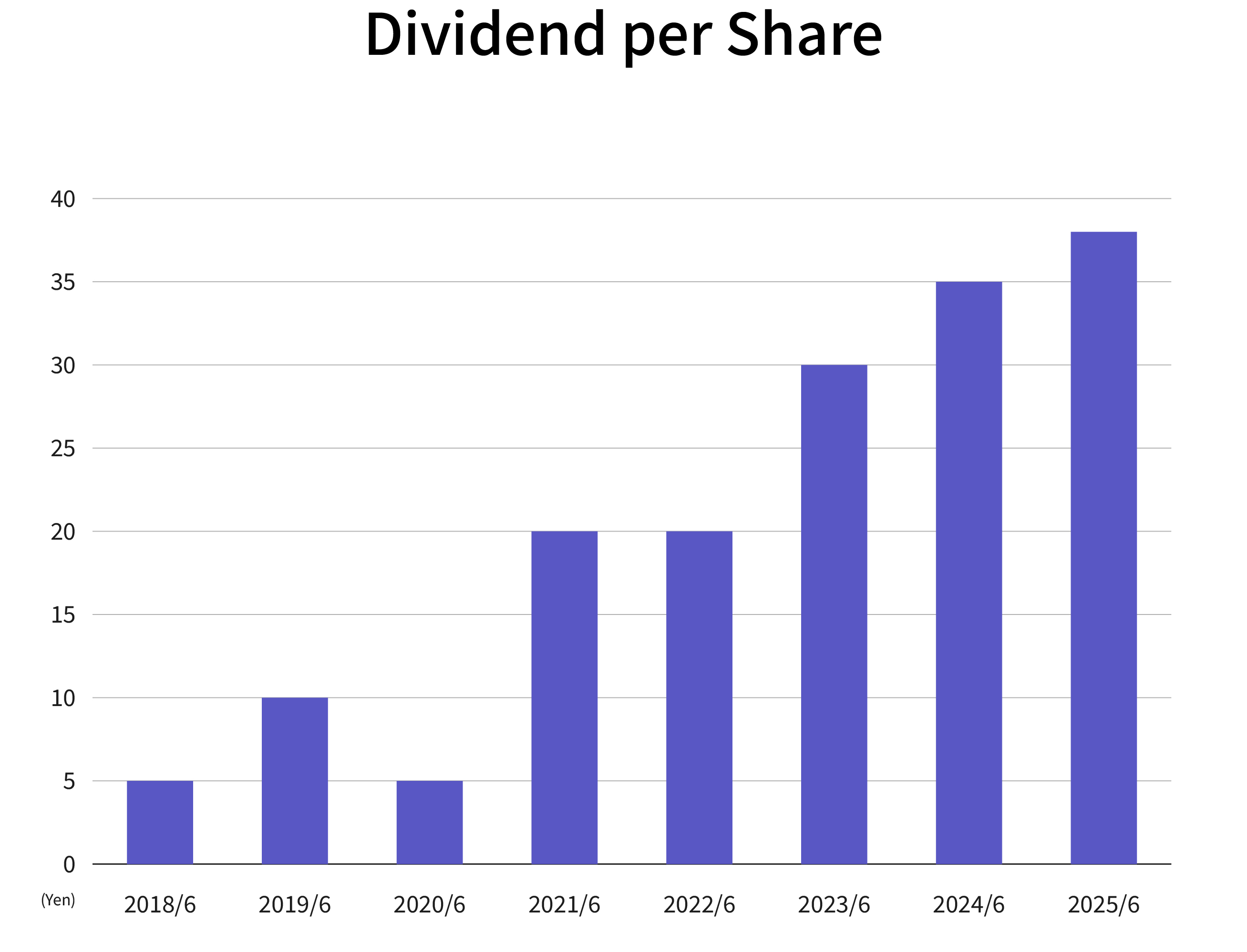

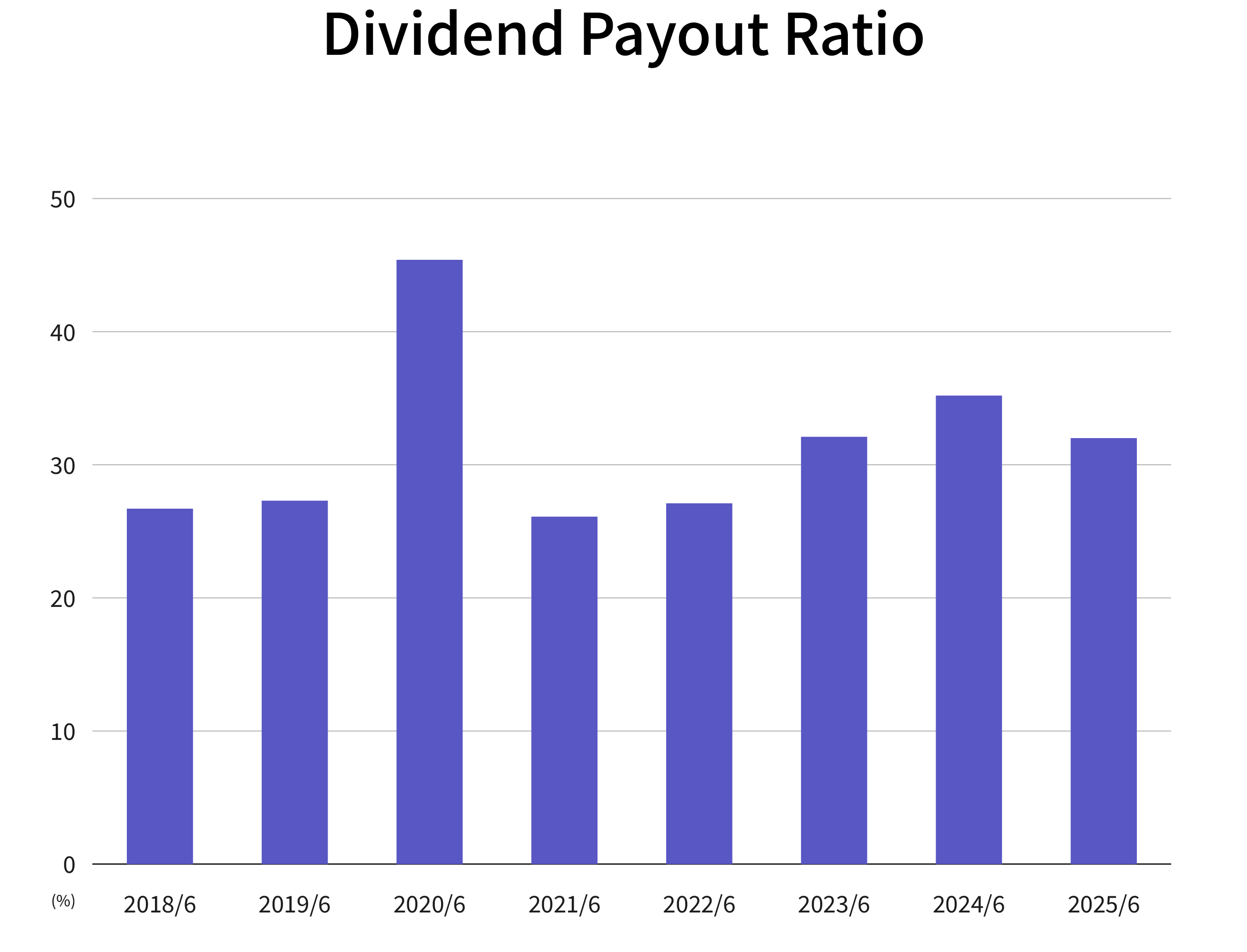

Basic Policy on Profit Distribution

To enhance the appeal of our stock, we aim to encourage long-term shareholding. To that end, we are considering shareholder benefit programs and targeting a medium-to-long term dividend payout ratio of 50%, with the goal of enhancing returns to our shareholders.

Dividend Information

Details of dividends per share are as follows:(Published on September 26, 2024)

| (Unit:Yen) | Interim period | End of term | Total | Dividend payout ratio(%) |

|---|---|---|---|---|

| FY 6/24 | 0.00 | 35.00 | 35.00 | 35.8 |

| FY 6/23 | 0.00 | 30.00 | 30.00 | 32.8 |

| FY 6/22 | 0.00 | 20.00 | 20.00 | 27.1 |

| FY 6/21 | 0.00 | 20.00 | 20.00 | 26.1 |

| FY 6/20 | 0.00 | 20.00 | 20.00 | 45.4 |

| FY 6/19 | 0.00 | 10.00 | 10.00 | 27.3 |

You can scroll horizontally ▶

Interim dividend・・・Paid in March of the following year with December 31 as the record date.

Year-end dividend・・・Paid in September with June 30 as the record date

Shareholder Benefits

| Number of shares held | Details of shareholder benefits | Record date |

|---|---|---|

| More than 100 shares Less than 300 shares |

Original QUO Card 1,000 yen | End of June each year |

| Over 300 shares | Original QUO Card 3,500 yen | End of June each year |

You can scroll horizontally ▶

Shareholders listed or recorded in the shareholder registry as of June 30 each year who hold at least one trading unit (100 shares) are eligible.

The gift is scheduled to be shipped in late September each year.

Company Overview

| Company Name | IPS Holdings Co., Ltd. |

|---|---|

| Founded | June, 1997 |

| Capital | JPY 255.25 million |

| Business |

Business Overview (Entire Group) Specialized in SAP implementation services, SAP operation support services, new business development, IT utilization & fostering consulting services, DX Services (Smart factory and office transformation support services ) and management of group companies |

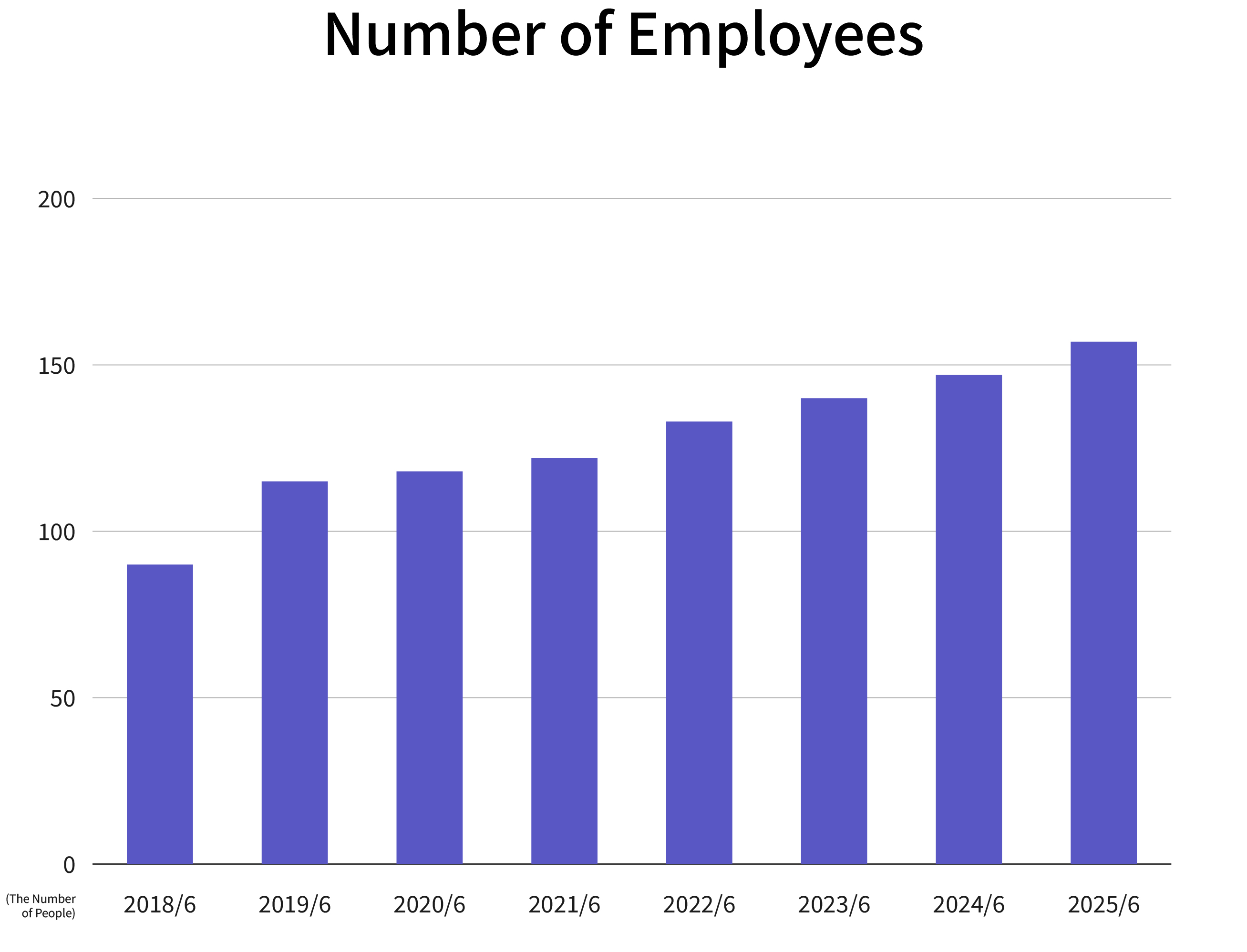

| Employees | 164 employees on a consolidated basis (as of July 1, 2025) |

| Listed Market | Tokyo Stock Exchange Standard Market (Listed on JASDAQ in December 2001) |

| Subsidiaries |

Domestic: IPS Co., Ltd, One Harmony Advisory Overseas:IPS HANOI COMPANY LIMITED |

| Headquarters |

Osaka Head Office: Grand Front Osaka Tower B, 16th Floor 3-1 Ofukacho, Kita-ku, Osaka 530-0011, Japan TEL: +81-6-6292-6236 (Main) FAX: +81-6-6292-6467 Tokyo Head Office: Hibiya International Building, 7th Floor 2-2-3 Uchisaiwaicho, Chiyoda-ku, Tokyo 100-0011, Japan TEL: +81-3-5501-3380 (Main) FAX: +81-3-5501-3387 |

Corporate History

| Jun., 1997 | Founded IPS Co., Ltd. in Sakae-machi-dori, Chuo-ku, Kobe, and launched ERP implementation services for SAP. |

|---|---|

| Jan., 1999 | Head office relocated to Kobe Harborland Center Building, Higashikawasaki-cho, Chuo-ku, Kobe |

| Dec., 2001 | Stock listed on the Japan Securities Dealers Association. |

| Oct., 2004 | Established branch office at Chiyoda-ku, Tokyo |

| May, 2012 | Head office relocated to Higashi-Kawasaki, Chuo-ku, Kobe due to business expansion. |

| Jul., 2012 | Tokyo Sales Office promoted to Tokyo Head Office |

| May, 2014 | Head office relocated from Higashikawasaki-cho, Chuo-ku, Kobe to the 16th floor of Grand Front Osaka Tower B, 3-1 Ohfuka-cho, Kita-ku, Osaka City, Osaka Prefecture due to business expansion |

| Apr., 2017 | Tokyo Head Office relocated from Fukoku Seimei Building, Uchisaiwai-cho, Chiyoda-ku, Tokyo to Hibiya International Building, 7F, 2-2-3 Uchisaiwai-cho, Chiyoda-ku, Tokyo due to business expansion |

| Sep., 2024 | Established IPS Corporate Split Preparation Company as a preparatory entity for the planned company split. |

| Jul., 2025 | As part of an intra-group reorganization through an absorption-type company split, the SAP business was transferred to IPS Co., Ltd. Split Preparation Company (a wholly owned subsidiary), which was subsequently renamed IPS Holdings Co., Ltd. At the same time, the former IPS Co., Ltd. Split Preparation Company changed its name to IPS Co., Ltd. |

Business Structure

- Toshihiro

Sekiguchi - Yasuhiko

Ikuta - Hiroshi

Watanabe - Yo

Akamatsu - Tomoko

Nakagawa

SAP Services Business

Yo Akamatsu,Executive Vice President and Representative Director, and President & CEO of IPS Co., Ltd.

Yasuhiko Ikuta,Director, IPS Co., Ltd.

IT Engineering Business

Hiroshi Watanabe,President & CEO, and Director of IPS Co., Ltd.

Toshihiro Sekiguchi,Deputy General Manager

Administration Department

Tomoko Nakagawa,Director and Manager of the Administration Department

Board of Directors

Board of Directors and Auditors

| President and Chief Executive Officer (Representative Director) |

Hiroshi Watanabe | Nov. 16, 1962 |

Apr. 1985 Joined KOBELCO SYSTEMS CORPORATION Jun. 1997 Established IPS, President and Representative Director of IPS (to present) Dec. 2001 Director, Fountain Limited ( to present) |

|

Senior Managing Director (Representative Director) President and Chief Executive Officer (Representative Director) of IPS Co.,Ltd. |

Yo Akamatsu | Sep.10, 1984 |

Apr. 2007 Joined IPS Jul. 2017 Executive Officer, Deputy General Manager of Sales Dept. Jul. 2018 Senior Executive Officer Jul. 2021 Managing Executive Officer, General Manager of SAP Services Dept. Sep. 2024 Director (to present) Sep. 2024 President & Representative Director, IPS Corporate Split Preparation Company (to present) Apr. 2025 Senior Managing Director (Representative Director) (to present) |

| Director Administration Dept. |

Tomoko Nakagawa | Jan. 24, 1971 |

Apr. 1994 Joined Pasona Inc. Feb. 1998 Joined IPS Jul. 2000 Manager, Administration Dept. Sep. 2021 Director, Manager, Administration Dept (to present) |

| Director | Takuo Enoki | Feb. 23,1963 |

Oct. 1985 Joined Ota Showa auditing firm(Ernst & Young ShinNihon LLC) Apr. 1997 Opened Enoki Certified Public Accountant and Certified Public Tax Accountant Office Jan. 2000 Representative Director, Management Refine Co. (to present) Oct. 2002 Representative member of Otemae Sogo Office Tax Co.(to present) Sep. 2005 External Statutory Auditor, KICHIRI HOLDINGS & Co., LTD. (to present) Jun. 2011 Outside Corporate Auditor of TOWA MECCS CORPORATION (Currently, TB GROUP INC.) (To Present) Sep. 2016 External Director of IPS (to present) |

| Full-time Auditor | Hisashi Kimura | Oct. 19, 1955 |

Apr. 1979 Joined Koyanagi Securities Co., Ltd. Apr. 2000 Joined Tsubasa Securities Co., Ltd. (currently Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.) Jan. 2012 Joined IPS Sep. 2012 Corporate Auditor of IPS (to present)) |

| Auditor | Kunihiro Anraku | Aug. 23, 1949 |

Apr. 1974 Joined Mitsui Banking Corporation (currently Sumitomo Mitsui Banking Corporation) Feb. 2002 Joined Nidec Corporation Mar. 2014 Representative of Anraku Administrative scrivener’s office(to present) Sep. 2015 Auditor of IPS (to present) |

| Auditor | Tetsuaki Hidehira | Apr. 30, 1972 |

Jul. 1995 Joined Nagai Judicial Scrivener and Land and House Investigator Office Dec. 1995 Passed the Judicial Scrivener Examination Jan. 1999 Started Hidehira Judicial Scrivener’s Office, Representative (to present) Sep. 2016 Auditor of IPS (to present) |

IPS Business

IPS Business Overview

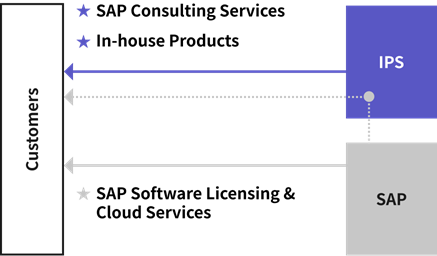

IPS provides IT consulting services but differs from general IT vendors in that we specialize solely in implementing SAP ERP systems. We are one of around 20 primary contractors in the SAP market and are certified as a Platinum Partner—SAP’s highest tier—in Japan.

Our revenue is almost entirely composed of SAP-related consulting services and proprietary product sales. We also handle SAP software licenses and cloud services. We do not sell generic hardware or software products.

To meet emerging client needs, we are exploring new digital transformation (DX) services utilizing advanced technologies such as AI and IoT.

Preparations are also underway for future expansion of SAP-related business in Asia.

IPS Strengths

Transforming an enterprise’s core system in just 1–2 years requires exceptionally high-level skills.

Our true strength lies in our ability to translate complex, company-wide operations—ranging from frontline activities to executive decision-making—into a single, cohesive system. We also provide consulting for business standardization and reform, based on deep expertise accumulated over years of dedicated work.

“EasyOne” is a comprehensive collection of knowledge and documentation developed from our 28 years of SAP implementation experience. It was the first officially certified tool for Japan’s mid-sized SAP market and is now provided to major hardware vendors and international partners under OEM agreements. It supports large-scale SAP projects across various industries, including sales, production, accounting, and global expansion.

With partners in approximately 70 countries, we offer global SAP ERP rollout support, including on-site implementation for subsidiaries and offices worldwide. Our partners are well-versed in local regulations and business customs. We are proud to offer one of Japan’s most robust global SAP support frameworks.

Our longstanding achievements have earned us SAP’s highest partner status—Platinum Partner—granted to only about 10 companies in Japan.

This trust enables us to conduct joint sales activities and deliver reliable systems and services in close collaboration with SAP.

We believe this offers significant peace of mind to our clients.

Our clients are those who bravely face intense competition and rapid change. Engaging with such clients is a privilege that continually inspires us. We make every effort to deeply understand their situations and limitations and firmly believe in the potential of IT to help solve their challenges. This belief is the foundation of IPS’s strength and will shape the development of our future products and services.

IPS Growth Strategy

Mid-Term Goals and Growth Strategy

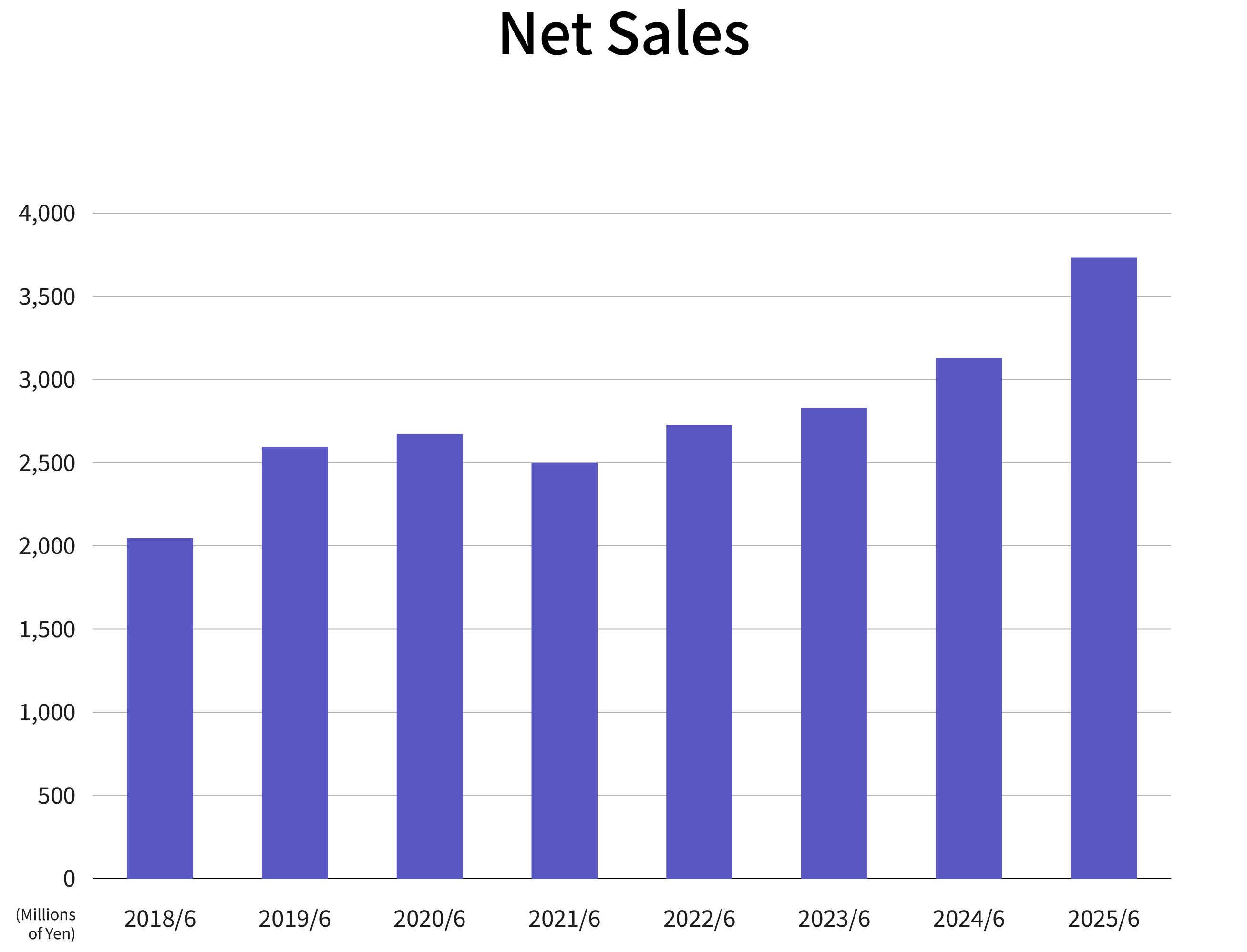

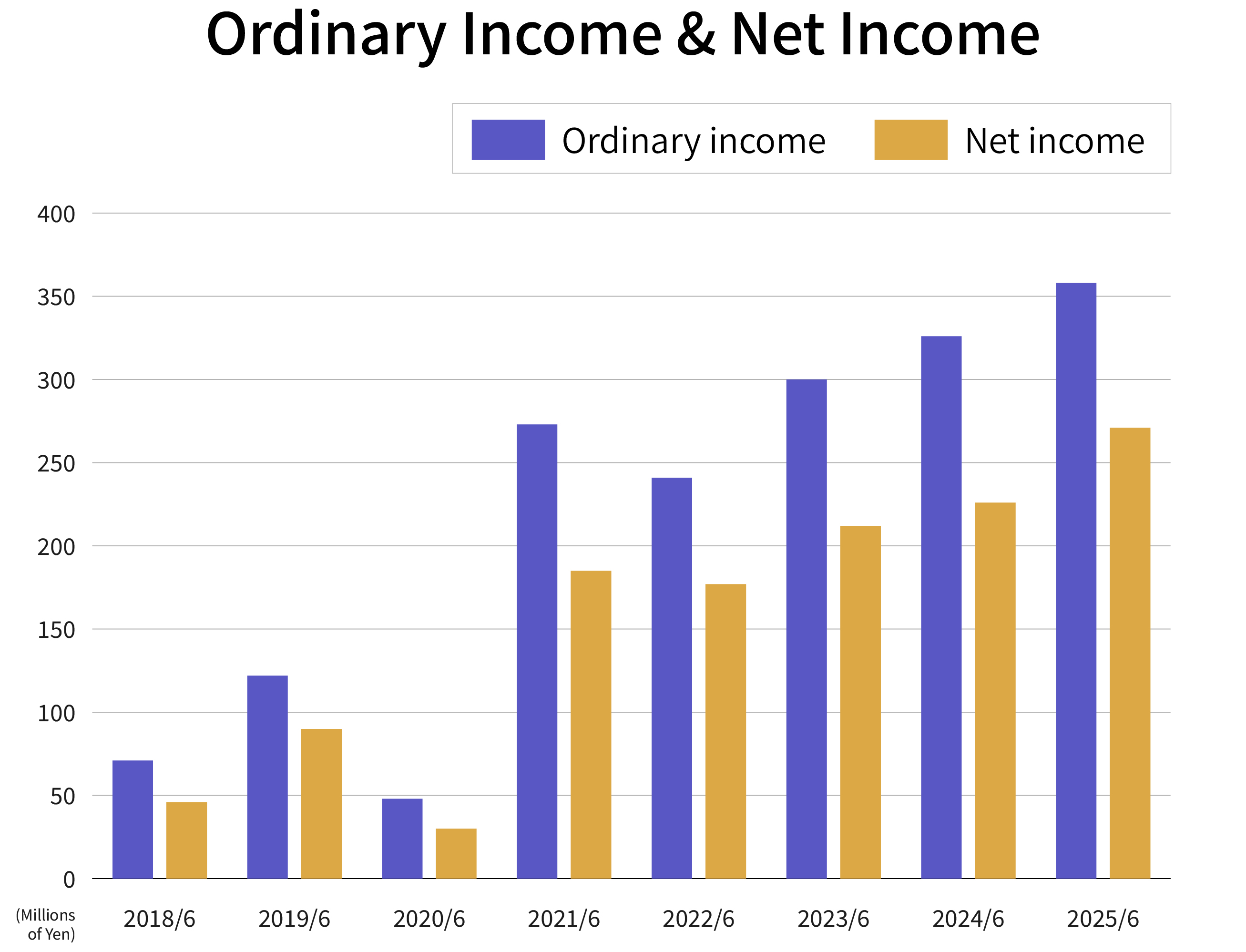

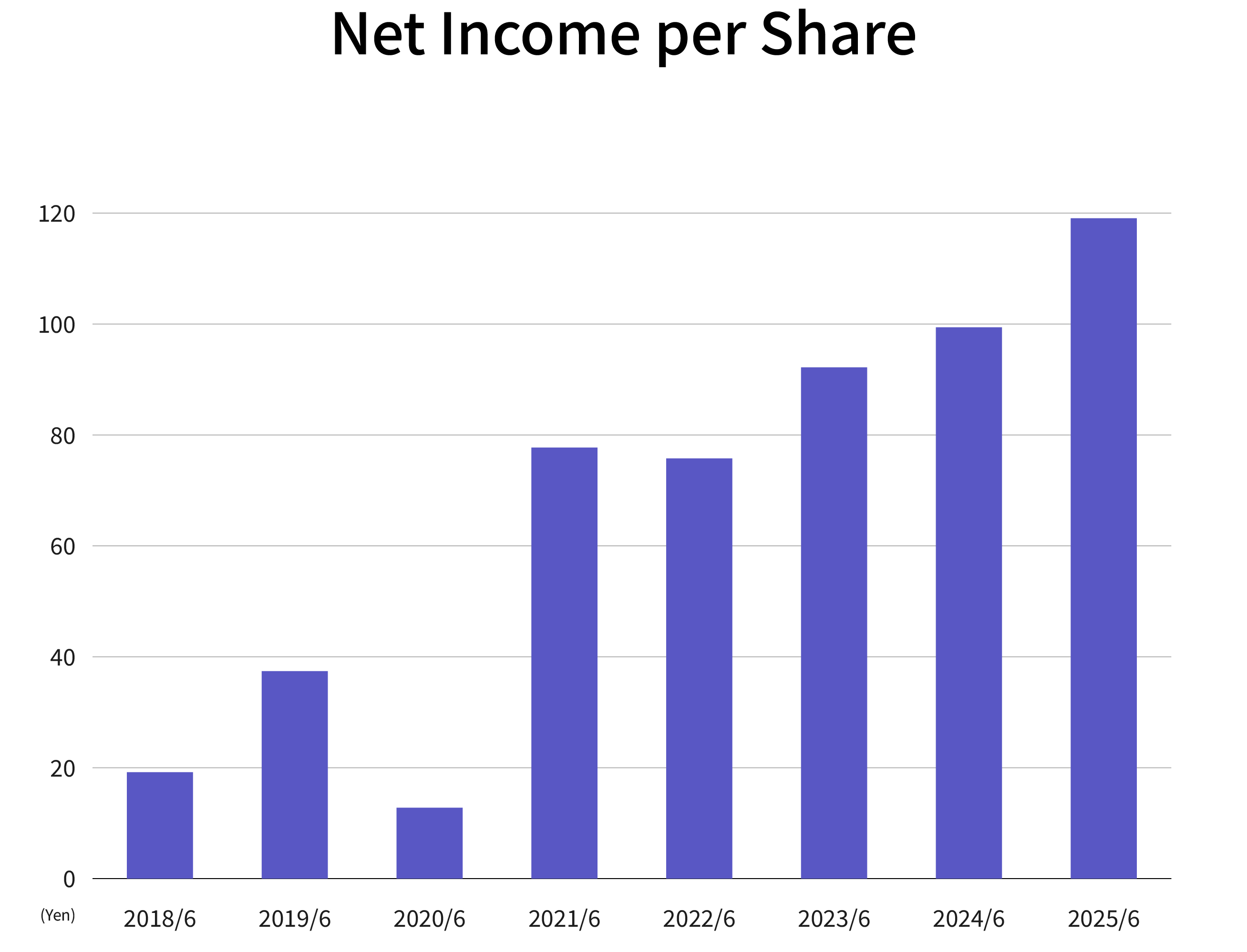

We aim to achieve ¥3 billion in sales and ¥350 million in recurring profit for the fiscal year ending June 2025. We also target an increase in EPS from ¥75 (FY 2022) to ¥100 by FY 2025.

To reach these goals, we are implementing the following three strategies

Business Development

and Polarization of Client Needs

Support Services

We foresee a surge in demand for SAP S/4HANA Cloud adoption as companies accelerate DX to overcome the “202X barrier.” IPS will continue focusing on high-value-added SAP implementations. We do not engage in low-value version upgrades. We will maintain our strong alliance with SAP while improving service quality and cost performance.

As SAP Public Cloud adoption grows, ERP implementation may become commoditized. Client needs will split between cost-effective core systems and investments in high-level IT for business impact. IPS is restructuring its delivery model for dramatic cost reductions and is developing high-value-added SAP services to lead the market.

Looking five years ahead, we plan to establish entirely new businesses inspired by insights gained from our client relationships. Using emerging technologies like AI and robotics, we aim to directly generate business value. Our initial focus is on developing smart factory solutions using AI and IoT.

Business Performance / Financial Topics

Stock Information

| Securities Code | 4335 |

|---|---|

| Listed Market | Tokyo Stock Exchange Standard Market ※July 2013 Listed on the Tokyo Stock Exchange JASDAQ ※Transferred to the Standard Market in April 2022 |

| Total number of authorized shares | 8,848,000 shares |

| Fiscal Year | July 1 – June 30 of the following year |

| Annual General Meeting of Shareholders | Within 3 months after the last day of each fiscal year |

| Record Date | June 30 |

| Number of Shares per Unit | 100 shares |

| Shareholder register administrator | Mitsubishi UFJ Trust and Banking Corporation |

| Handling Office |

Osaka Securities Agent Department, Mitsubishi UFJ Trust and Banking Corporation 3-6-3 Fushimi-cho, Chuo-ku, Osaka 541-8502, Japan |

| Transfer Agent | Mitsubishi UFJ Trust and Banking Corporation, branches nationwide |

| Telephone Inquiries | 0120-094-777 (toll free) |

| Procedures |

For details, please refer to this page https://www.tr.mufg.jp/daikou/ |

| Method of Public Notices |

Public notices of the Company are posted electronically. Electronic public notices are posted on the Company’s website at the following address: https://www.ips.ne.jp/kessan.html However, if electronic public notices are not available due to an accident or other unavoidable reasons, public notices will be posted in the Nihon Keizai Shimbun. |

Corporate Governance

To respond swiftly to a rapidly changing environment, we have established a governance system tailored to our company size. We also prioritize transparency and sound management by enhancing disclosure practices.

Our company adopts the Board of Auditors system. The Board consists of three members, including two external auditors. In addition to holding regular monthly meetings, extraordinary meetings are convened as necessary. Each auditor conducts audits of business execution in accordance with audit standards and plans established by the Board of Auditors. Furthermore, by working in cooperation with the Internal Audit Office, we ensure compliance with relevant laws and internal regulations, thereby maintaining transparency and enabling timely and effective oversight and governance functions.

The Board of Directors is composed of four members, including one external director. Regular board meetings are held monthly, with additional meetings convened when necessary to deliberate and decide on matters required by law and other key management issues. The Board continually monitors the execution of business operations. In addition, we hold management meetings flexibly to enhance the transparency, fairness, and speed of decision-making.

The names of the members of the Board of Directors and the Board of Auditors—five directors and three auditors in total—are listed in the executive summary.

As a company with a Board of Auditors, we have established a governance system that ensures objectivity and neutrality by maintaining an independent and fair position in evaluating the effectiveness and efficiency of directors’key business executions. We believe this structure enables a fully functional framework for corporate oversight.

Compliance—fundamental to corporate governance—is managed by our Administration Department, which works closely with external experts such as legal counsel, certified public accountants, and our lead securities firm. This ensures thorough understanding and adherence to legal and regulatory requirements across all levels of the organization, from executives to employees.

When appointing outside directors and auditors, we adhere to the independence criteria defined by the Tokyo Stock Exchange. We carefully select individuals with extensive knowledge and proven expertise across various fields, while also ensuring they are independent from our executive management team.