For Investors

Message from the President

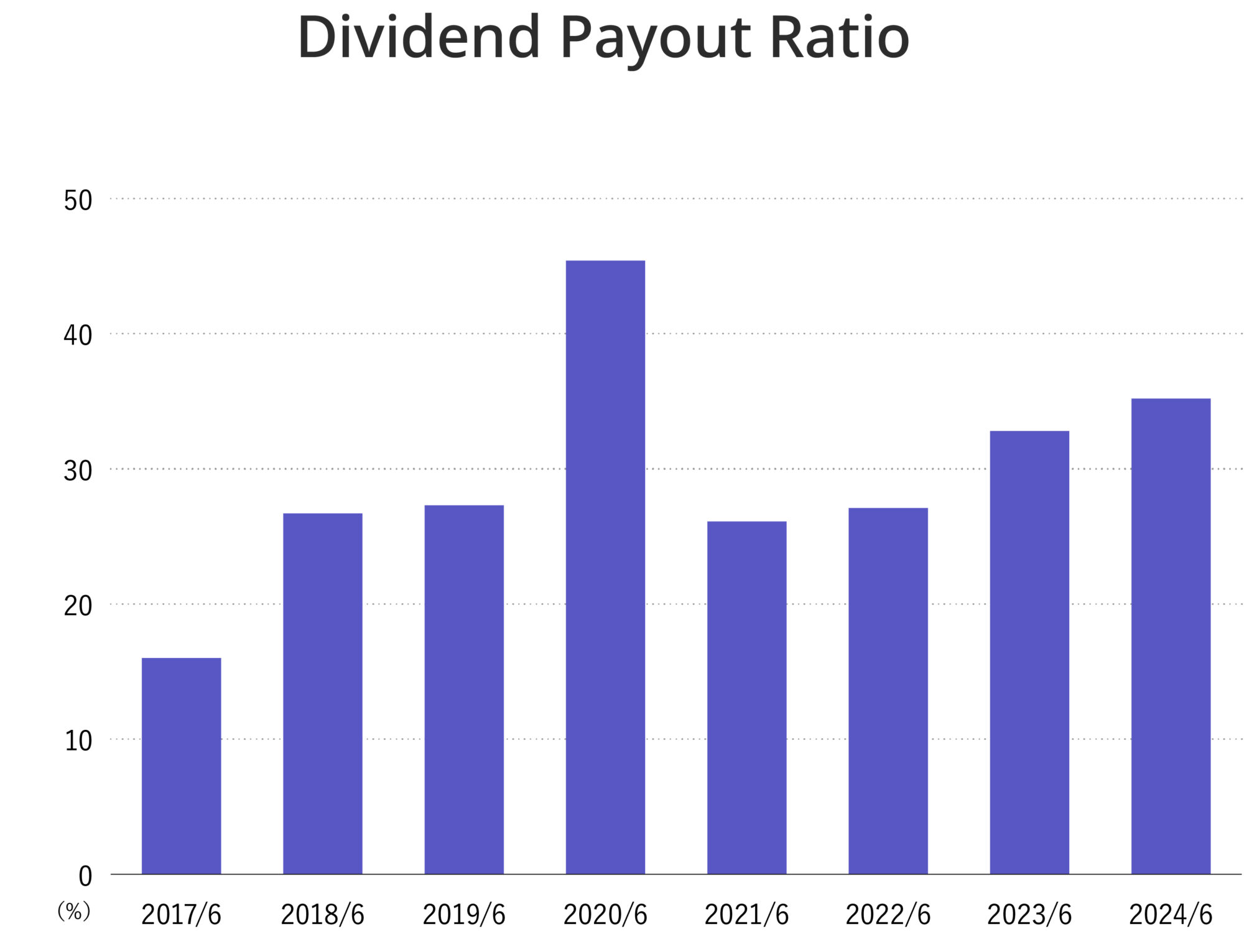

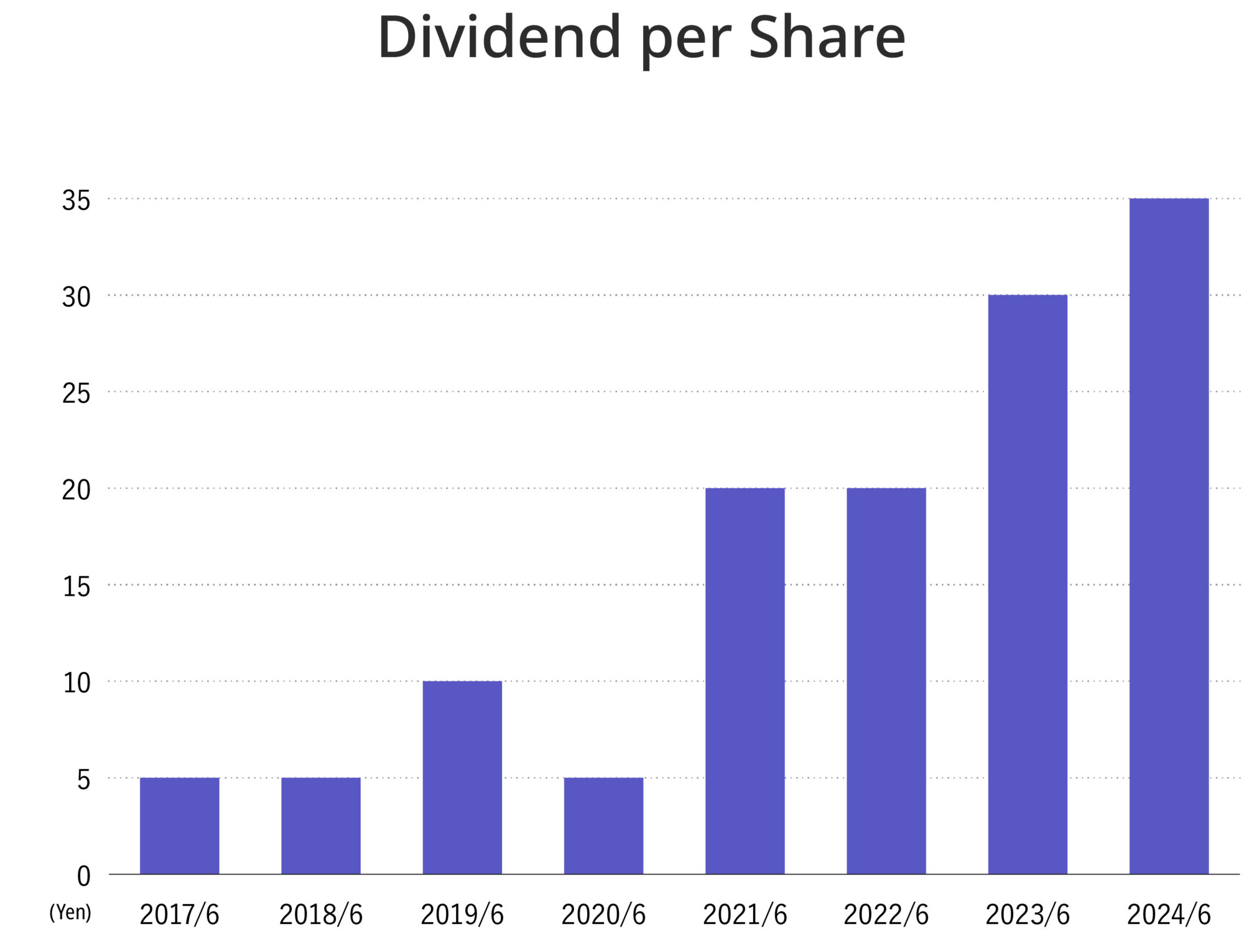

Basic Policy on Profit Distribution

By increasing the investment attractiveness of our shares, we hope to encourage more people to hold our shares over the long term. Therefore, we will make efforts to further return profits to our shareholders by considering special benefits for long-term stock holders and aiming for a dividend payout ratio of 50% in the medium to long term.

Basic Dividend Policy

Dividend per share

Dividends per share are as follows.

(April 23, 2023 Release)

| (Unit: Yen) | Interim period | End of term | Total | Dividend payout ratio(%) |

| Fiscal year ending June 30, 2024 | 0.00 | 35.00 | 35.00 | 35.2 |

| Fiscal year ending June 30, 2023 (planned) | 0.00 | 30.00 | 30.00 | - |

| Fiscal year ending June 30, 2022 | 0.00 | 20.00 | 20.00 | 27.1 |

| Fiscal year ending June 30, 2021 | 0.00 | 20.00 | 20.00 | 26.1 |

| Fiscal year ending June 30, 2020 | 0.00 | 20.00 | 20.00 | 45.4 |

| Fiscal year ending June 30, 2019 | 0.00 | 10.00 | 10.00 | 27.3 |

Interim dividend: Paid in March of the following year with December 31 as the record date.

Year-end dividend: Paid in September with June 30 as the record date

Shareholder Benefit Plan

Details of shareholder benefits

| Number of shares held | Details of shareholder benefits | Record date |

| More than 100 shares Less than 300 shares | Original QUO Card 1,000 yen | End of June each year |

| More than 300 shares | Original QUO Card 3,500 yen | End of June each year |

Eligible shareholders

Shareholders listed or recorded in the shareholders’ register as of June 30 of each year who hold at least one unit (100 shares) are eligible.

Corporate Information

Company Profile

| Company name | IPS Co., Ltd. Innovation Partner with SAP |

| Founded | June,1997 |

| Capital | JPY 255.25 million |

| Business | Spcialized in SAP Implementation service, SAP Operation Support Services New business development and IT utilization and effectiveness fostering consulting DX Service (Improvement and office smartness support) |

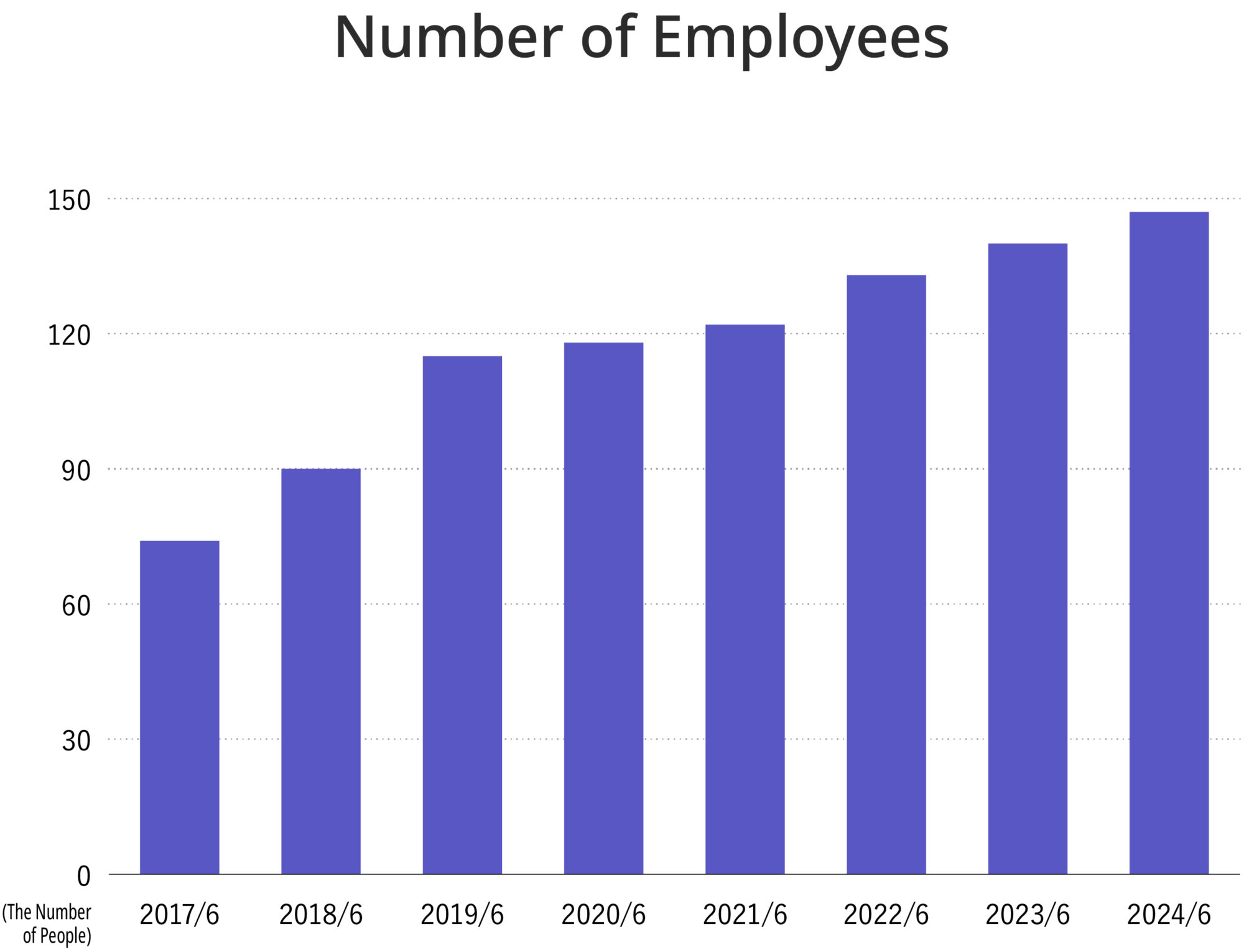

| No. of employees | 142 (as of April 1, 2023) |

| Listed Market | Tokyo Stock Exchange Standard Market (Listed on JASDAQ in December 2001) |

| Adress | Osaka Head Office Grand Front Osaka, Tower B, 16th Fl, 3-1 Ofuka-cho, Kita-ku, Osaka,530-0011, Japan TEL:+81-6-6292-6236 FAX:+81-6-6292-6467 Tokyo Head Office Hibiya International Bldg., 7th Fl, 2-2-3, Uchisaiwai-cho, Chiyodaku-ku, Tokyo, 100-0011, Japan TEL:+81-3-5501-3380 FAX:+81-3-5501-3387 |

| subsidiary | Japan: One Harmony Advisory Overseas: IPS HANOI COMPANY LIMITED |

Corporate History

| Jun., 1997 | Founded IPS Co., Ltd. in Sakae-machi-dori, Chuo-ku, Kobe, and started SAP ERP implementation business. |

| Jan., 1999 | Head office relocated to Kobe Harborland Center Building, Higashikawasaki-cho, Chuo-ku, Kobe |

| Dec., 2001 | Stock listed on the Japan Securities Dealers Association. |

| Oct., 2004 | Established branch office at Chiyoda-ku, Tokyo |

| May, 2012 | Head office relocated to Higashi-Kawasaki, Chuo-ku, Kobe due to business expansion. |

| Jul., 2012 | Tokyo Sales Office promoted to Tokyo Head Office |

| May, 2014 | Head office relocated from Higashikawasaki-cho, Chuo-ku, Kobe to 16th floor of Grand Front Osaka Tower B, 3-1 Ohfuka-cho, Kita-ku, Osaka City, Osaka Prefecture due to business expansion |

| Apr., 2017 | Tokyo Head Office relocated from Fukoku Seimei Building, Uchisaiwai-cho, Chiyoda-ku, Tokyo to Hibiya Kokusai Building, 7F, 2-2-3 Uchisaiwai-cho, Chiyoda-ku, Tokyo due to business expansion |

IPS Business

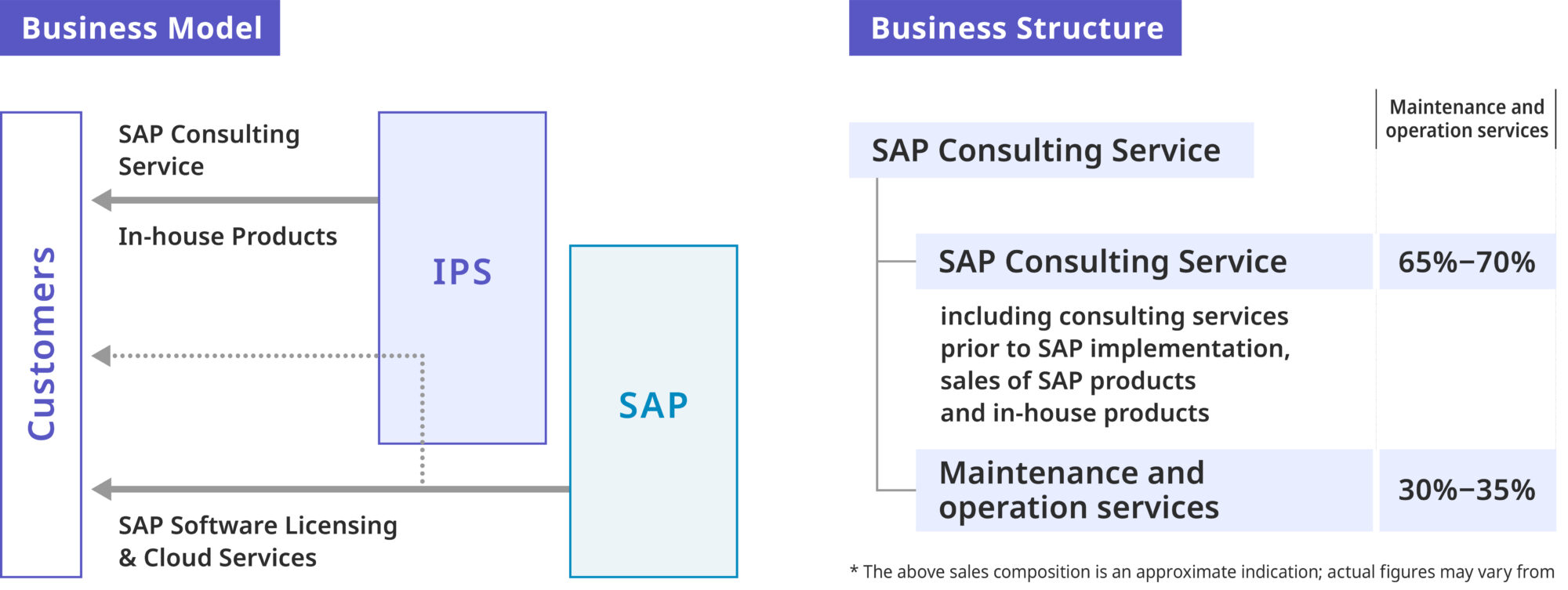

IPS Business Overview

SAP specialist, one of Japan’s leading vendors in the SAP market

IPS is an IT consulting service provider, but unlike most IT vendors that offer a variety of products and services, we specialize in the business of implementing SAP ERP for our customers. We are one of the prime contractors (about 20 companies) in the SAP market and are certified as a Platinum Partner (about 10 companies in Japan), the highest level of the SAP Partner System.

Providing consistent services from the pre-implementation phase of SAP to post-implementation maintenance

Our sales consist almost entirely of SAP consulting services and sales of our own products, including some SAP software licenses and cloud services. We do not sell any other general hardware or software.

Initiatives to establish new businesses

In order to meet the new needs of our customers, we have started to establish a business for so-called DX services, which are services that utilize new information technologies such as AI/IOT. We are also preparing for future SAP-related business development in the Asian region.

Strengths of IPS

Business know-how and technical expertise built up through dedicated services

Extremely high technical capabilities are required to renew a company’s mission-critical business systems in just 1-2 years. Holistic design capability is essential to capture the entire enterprise, from the field operations at the end of the enterprise to the operations that support high-level management decision-making and incorporate them into a single system.

In addition, consulting capabilities to guide business standardization and business reform and improvement in business design are also required. Our essential strength is the know-how and capabilities we have developed and accumulated on a daily basis.

Product development system and in-house template product “EasyOne”

Our template product, “EasyOne,” is the fruit of such technological development and accumulation. This product covers business processes in the Japanese manufacturing industry, trading companies, and wholesalers, and provides advanced planning and management operations based on global standards, which are implemented in SAP in advance. In addition, we develop and provide project methodologies and services that leverage this product to implement SAP safely and with less burden. Rather than relying on the abilities of our engineers, we have established a concept and system within the company that capitalizes on know-how through our products and methodologies and achieves quality with them.

Global support system for customers

In cooperation with our partners in about 70 countries around the world, we have built a system that can support our customers. We can provide on-site support for the implementation and deployment of SAP ERP to your subsidiaries, affiliates, and offices in various countries, together with partners who are familiar with local legal systems and business customs. Our global support system is one of the best in Japan.

Highly trusted by SAP, Platinum Partner

SAP has recognized us as a Platinum Partner (about 10 companies in Japan), the highest rank of partner, for our long-standing activities. Based on the high-level trust that SAP has placed on us, we engage in sales activities together with SAP, and work together with SAP to practice providing systems and services that support our customers’ business operations.

We believe this is a great relief for our customers.

Understanding customers

Customers who choose SAP are those who are boldly striving to move forward while facing a highly competitive environment and significant change. Our relationships with such customers are a treasure for us, and they inspire us to take new directions in order to contribute to our customers. We understand the challenges our customers face and the limitations of their ability to solve these problems, and we are convinced of the potential of IT and our contribution in solving them. This is the root of great strength for IPS in the future, and we will work to realize products and services that embody this in the future.

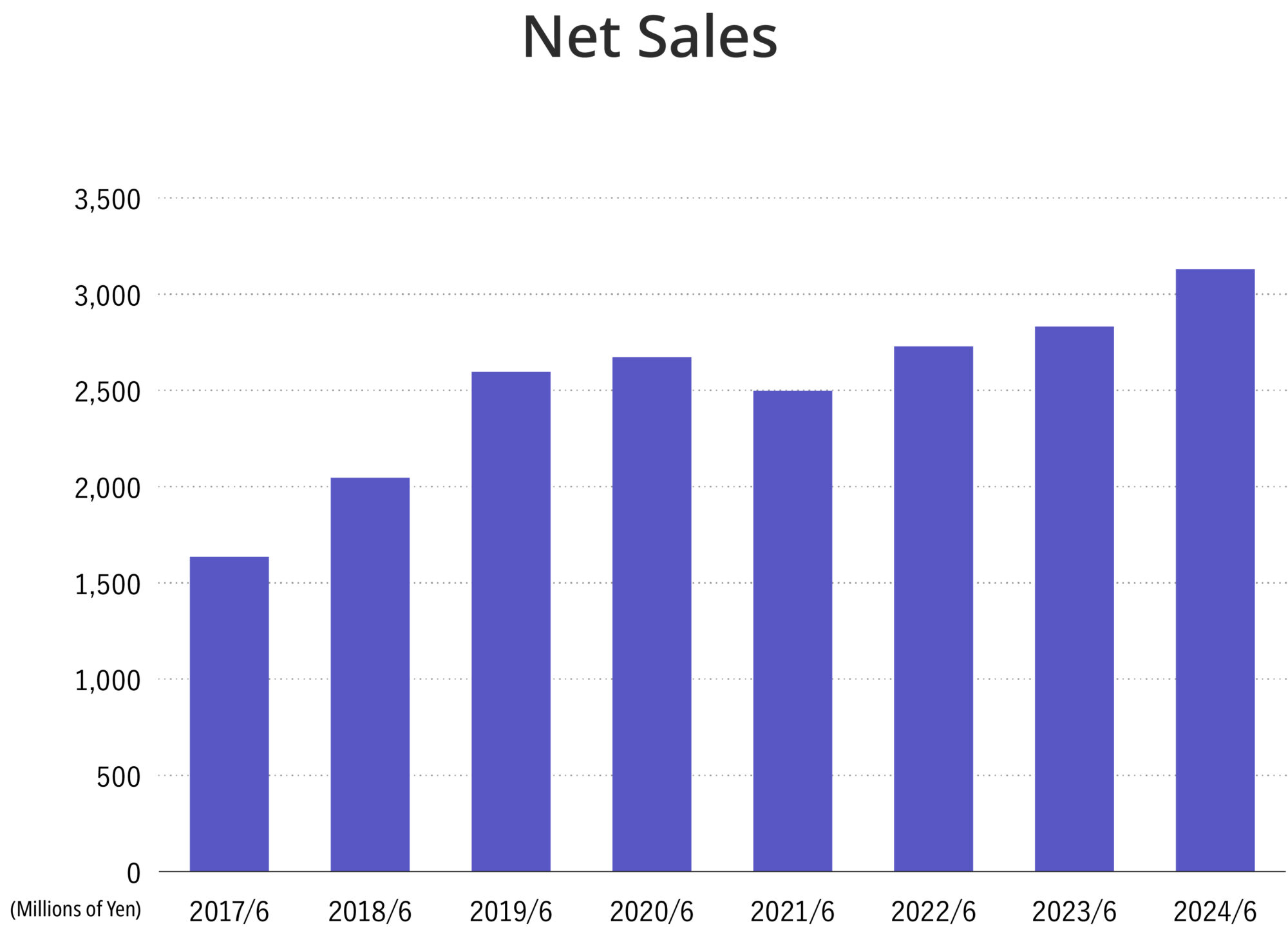

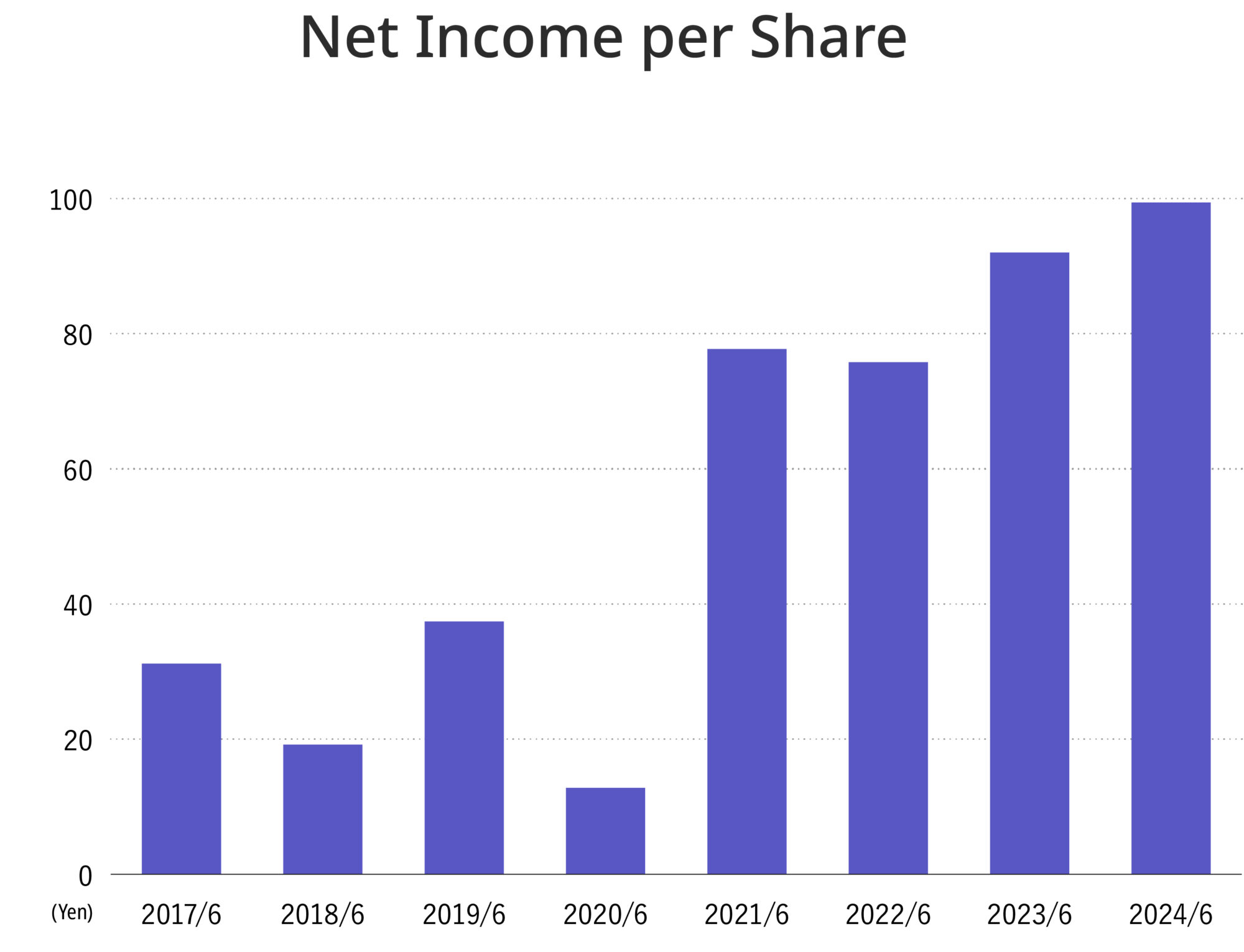

IPS’s Growth Strategy

IPS’ medium-term goal and growth strategy

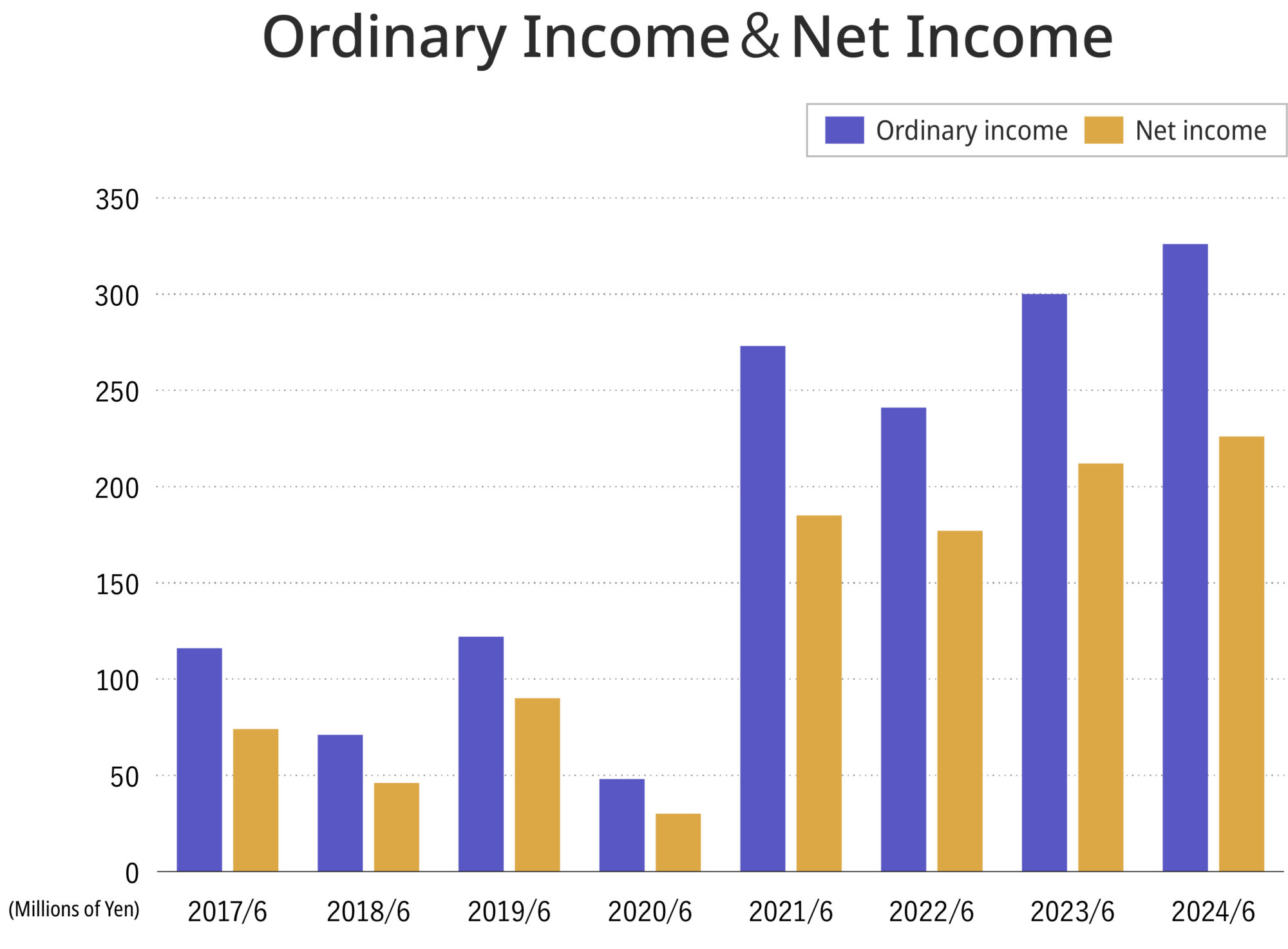

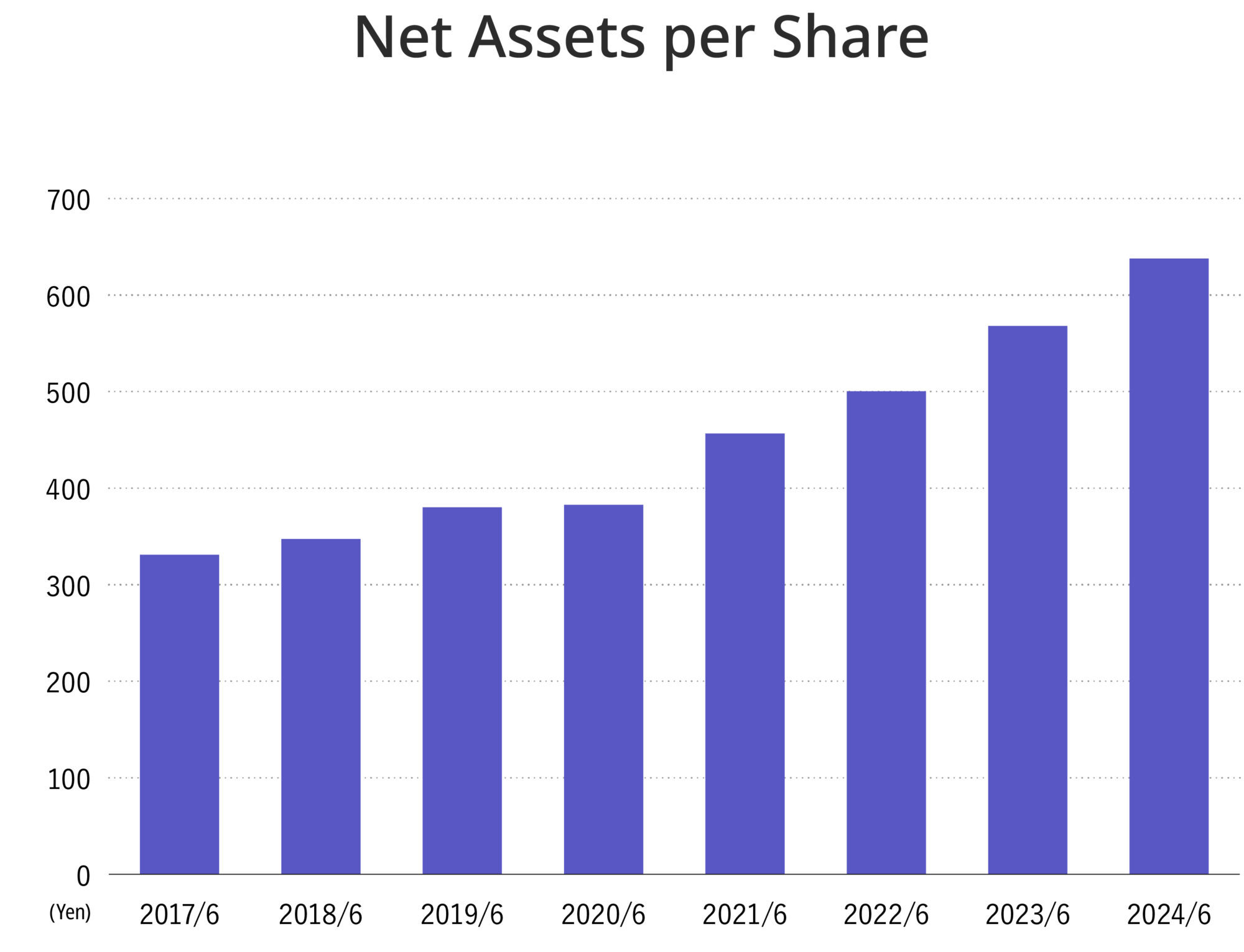

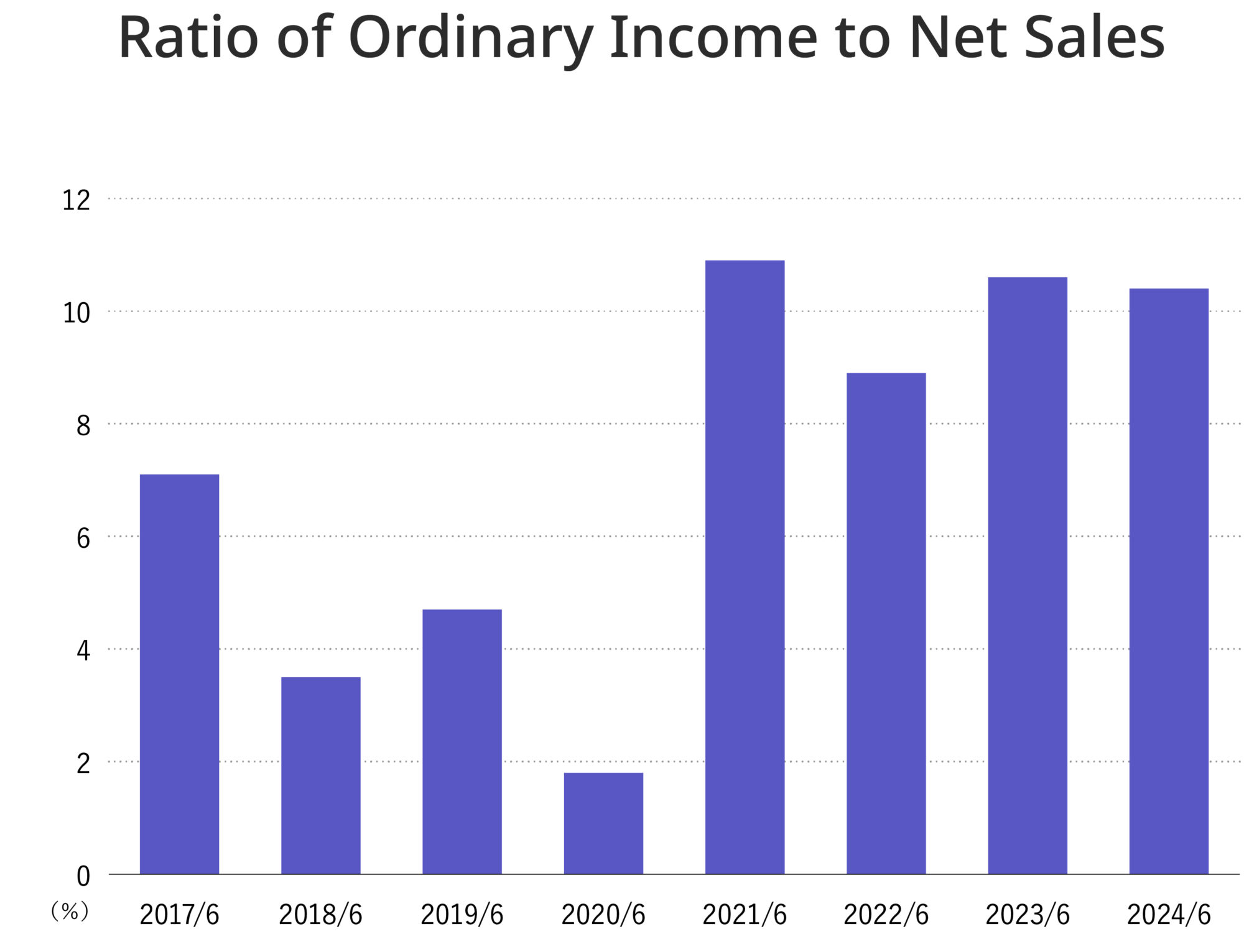

Our goals are to achieve sales of 3 billion yen and ordinary income of 350 million yen in the fiscal year ending June 30, 2025, and to increase earnings per share from 75 yen in the fiscal year ending June 30, 2022 to 100 yen in the fiscal year ending June 30, 2025. We will work toward this goal with the following three strategies.

Mid-term

Continue business strategy of DX support to date

In the medium term, we expect that many companies will focus on digital transformation to overcome the 202X barrier, and as a result, the implementation of SAP S/4 HANA Cloud will become more and more active. We will continue to focus on the business of implementing new value-added SAP as we have in the past. (We will not conduct the business of upgrading to S/4 HANA, which has low value added.) In order to capture those customer needs, we will continue our steady efforts as before, i.e., keeping up with SAP cloud products and services, improving the quality of our products and services, and improving cost performance under our strong alliance with SAP.

Mid-to Long-term

Respond to the rise of SAP public cloud and polarization of customer needs

We believe that the SAP public cloud will begin to spread in earnest, and at the same time, ERP implementation itself should become a commodity. Customer needs will polarize between reducing core system implementation costs and investing in more advanced IT utilization to create business benefits. In response to these market changes, IPS will dramatically reduce costs through structural reform of the delivery system for SAP implementation services, and in addition, IPS will begin to develop high value-added services to support the use of SAP, aiming to become the market leader.

Mid-to Long-term

Launch of new DX support service itself

In addition, new businesses will be created and established over the next five years.

This is based on the idea that we have gained from our treasured relationships with our customers and aims to create more direct management effects by utilizing various new technologies, such as AI and robotics. First, we are working on developing services to make factories smarter using AI/IOT technology.

Business Promotion Structure

SAP Service Department

Yo Akamatsu: Managing Executive Officer, General Manager of SAP Service Dept.

Yasuhiko Ikuta: Senior Executive Officer, Deputy General Manager of SAP Service Dept.

IT Engineering Department

Hiroshi Watanabe: President and CEO, General Manager of IT Engineering Dept.

Toshihiko Sekiguchi: Director, Deputy General Manager of IT Engineering Dept., General Manager of Office of the CEO

Administrative Department

Tomoko Nakagawa: Director, Manager of Administrative Dept.

Board of Directors and Auditors

President and Chief

Executive Officer

(Representative Director)

Hiroshi Watanabe

Nov. 16, 1962

| Apr. 1985 | Joined KOBELCO SYSTEMS CORPORATION |

|---|---|

| Jun. 1997 | Established IPS, President and Representative Director of IPS (to present) |

| Dec. 2001 | Director, Fountain Limited ( to present) |

Director

In charge of Business Development Dept.

Naohiko Kuge

Nov. 17, 1967

| Apr. 1988 | Joined Kansai JBA Corporation (now Toshiba Information Systems Corporation) |

|---|---|

| Jul. 1997 | Joined IPS |

| Sep. 2002 | Director |

| Dec. 2020 | In charge of Business Development Dept. (to present) |

Director

General Manager,

Office of the CEO

Toshihiko Sekiguchi

Sep. 5,1979

| Apr. 2002 | Joined IPS |

|---|---|

| Sep. 2013 | Director |

| Sep. 2016 | Executive Officer |

| Sep. 2022 | Director (to present) |

Director

Administration Dept.

Tomoko Nakagawa

Jan. 24, 1971

| Apr. 1994 | Joined Pasona Inc. |

|---|---|

| Feb. 1998 | Joined IPS |

| Jul. 2000 | Manager, Administration Dept. |

| Sep. 2021 | Director, Manager, Administration Dept (to present) |

Director

Takuo Enoki

Feb. 23,1963

| Oct. 1985 | Joined Ota Showa auditing firm(Ernst & Young ShinNihon LLC) |

|---|---|

| Apr. 1997 | Opened Enoki Certified Public Accountant and Certified Public Tax Accountant Office |

| Jan. 2000 | Representative Director, Management Refine Co. (to present) |

| Oct. 2002 | Representative member of Otemae Sogo Office Tax Co.(to present) |

| Sep. 2005 | External Statutory Auditor, KICHIRI HOLDINGS & Co., LTD. (to present) |

| Jun. 2011 | Outside Corporate Auditor of TOWA MECCS CORPORATION (Currently, TB GROUP INC.) (To Present) |

| Sep. 2016 | External Director of IPS (to present) |

Full-time Auditor

Hisashi Kimura

Oct. 19, 1955

| Apr. 1979 | Joined Koyanagi Securities Co., Ltd. |

|---|---|

| Apr. 2000 | Joined Tsubasa Securities Co., Ltd. (currently Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.) |

| Jan. 2012 | Joined IPS |

| Sep. 2012 | Corporate Auditor of IPS (to present)) |

Auditor

Kunihiro Anraku

Aug. 23, 1949

| Apr. 1974 | Joined Mitsui Banking Corporation (currently Sumitomo Mitsui Banking Corporation) |

|---|---|

| Feb. 2002 | Joined Nidec Corporation |

| Mar. 2014 | Representative of Anraku Administrative scrivener’s office(to present) |

| Sep. 2015 | Auditor of IPS (to present) |

Auditor

Tetsuaki Hidehira

Apr. 30, 1972

| Jul. 1995 | Joined Nagai Judicial Scrivener and Land and House Investigator Office |

|---|---|

| Dec. 1995 | Passed the Judicial Scrivener Examination |

| Jan. 1999 | Started Hidehira Judicial Scrivener’s Office, Representative (to present) |

| Sep. 2016 | Auditor of IPS (to present) |

Financial Results and Topics

Stock Information & Corporate Governance

Stock Memo

| Securities Code | 4335 |

| Listed Market | Tokyo Stock Exchange Standard Market ※July 2013 Listed on the Tokyo Stock Exchange JASDAQ ※Transferred to the Standard Market in April 2022 |

| Total number of authorized shares | 8,848,000 shares |

| Fiscal Year | July 1 – June 30 of the following year |

| Annual General Meeting of Shareholders | Within 3 months after the last day of each fiscal year |

| Record Date | June 30 |

| Number of Shares per Unit | 100 shares |

| Shareholder register administrator | Mitsubishi UFJ Trust and Banking Corporation |

| Handling Office | Osaka Securities Agent Department, Mitsubishi UFJ Trust and Banking Corporation 3-6-3 Fushimi-cho, Chuo-ku, Osaka 541-8502, Japan |

| Transfer Agent | Mitsubishi UFJ Trust and Banking Corporation, branches nationwide |

| Telephone Inquiries | 0120-094-777 (toll free) |

| Procedures | For details, please refer to this page https://www.tr.mufg.jp/daikou/ |

| Method of Public Notices | Public notices of the Company are posted electronically.Electronic public notices are posted on the Company’s website at the following address: https://www.ips.ne.jp/kessan.html However, if electronic public notices are not available due to an accident or other unavoidable reasons, public notices will be posted in the Nihon Keizai Shimbun. |

Corporate Governance

①Corporate Governance

In order to respond to the rapidly changing business environment, we have established a corporate governance system that is appropriate for the size of the company as well as to speed up management decision making. In addition, we strive to enhance disclosure to ensure the transparency and soundness of management.

②Outline of corporate governance system and reasons for adopting such system

Outline of the corporate governance system

We have adopted a Board of Corporate Auditors system. The Board of Corporate Auditors consists of three members, including two outside corporate auditors. In addition to the regular monthly meetings of the Board of Corporate Auditors, extraordinary meetings are held as needed, and each corporate auditor audits the legality of business execution in accordance with the audit standards and audit plan established by the Board of Corporate Auditors. Furthermore, in cooperation with the Internal Audit Office, the Board of Corporate Auditors performs transparent, timely, and appropriate monitoring and management oversight functions through audits of compliance with various laws, regulations, and internal rules and regulations.The Board of Directors consists of five directors (one outside director), and in addition to regular monthly meetings, extraordinary meetings are held as needed to make decisions on matters required by law and important management matters, and to constantly supervise the status of business execution. In addition, management meetings are held flexibly to maintain and improve the transparency, fairness, and speedy decision-making of management. The names of the members of the Board of Directors and the Board of Corporate Auditors are the five directors and three corporate auditors shown in the list of ”Board of Directors and Auditors.”

Reasons for adopting the corporate governance system

As a company with a board of auditors, we have established a governance system that ensures objectivity and neutrality by, for example, verifying the effectiveness and efficiency of the directors’ execution of important operations from an independent and fair standpoint, and we believe that the system is fully functional in terms of management oversight functions. “Administration Department” oversees compliance (legal compliance), which is the foundation of corporate governance, and works with outside specialists such as lawyers, certified public accountants, and managing securities companies to ensure that all officers and employees are fully aware of the importance of compliance.In appointing outside directors and outside corporate auditors, we select persons with abundant knowledge and experience in various fields and with consideration for ensuring their independence from management, in accordance with the various rules on independence stipulated in the regulations of the Tokyo Stock Exchange and other relevant regulations.